At EconIntersect we like to take a long view of the economy and not worry about the short term swings. The changes are happening so fast in our world it is hard to determine a long or short view. Here are a few thoughts on our world situation right now by some prominent voices on the economy and our problems.

Peter Schiff head of Euro Pacific Capitol

"While the outcome of the Super Committee shouldn't have come as a great surprise, the sheer dysfunction displayed should serve as a wakeup call for those who still harbor any desperate illusions.

In the mean time, the prospect of sovereign default in Europe is driving "safe" haven demand for the dollar. So contrary to the political blame game, Europe's problems are actually providing a temporary boost to America's bubble economy. However, a resolution to the crisis in Europe could reverse those flows. And given the discipline emanating from Berlin, a real solution is not out of the question. If confidence can be restored there, each episodic flight to safety may be less focused on the U.S. dollar. Instead, risk-averse investors may prefer a basket of other, higher-yielding, more fiscally sustainable currencies.

There is an old saving that one often does not appreciate what one has until it's lost. The nearly criminal foolishness now on display in Washington may finally force the rest of the world to cancel our reserve currency privileges. The loss may give Americans a profound appreciation of this concept."

Excerpts from an article by John Reeves on Mike Mayo, a bank analyst who has been covering Wall Street for more than 20 years.

"Our recent financial crisis "didn't occur because of something that banks did. No, it was the natural consequence of the way banks are, even today." In his new book, Exile on Wall Street, Mayo argues that the big Wall Street banks are set up nowadays to take excessive risks, while providing outsized compensation for bankers. And despite numerous though lightly enforced regulations, the federal government is there to bail these institutions out when things go wrong. Mayo believes that Citigroup (NYSE: C ) , which he describes as the "poster child for the financial industry's problems," provides a perfect example of all that is wrong with our big banks right now. Mayo shows us that over the past decade Citi has been "involved in virtually every major financial screw-up, from Enron to WorldCom, to the analyst scandals of the tech bubble, to the mortgage fiasco. Perhaps the worst part of the entire Citi story of recent years is that nothing has changed, according to Mayo. He feels that the dubious accounting, excessive risks, and outsized executive pay "are still happening." He writes, "It's like we've learned nothing. It's Wall Street."

Mike Larson of Safe Money Report

"Governments and central banks around the world have borrowed, printed, and spent far too much over the past few years bailing out anyone and everyone. Those moves temporarily postponed a massive wipe out in global capital markets. But they also transformed the PRIVATE credit crisis we were experiencing in 2007-2009 into a massive SOVEREIGN credit crisis. Now, the second phase of the crisis is taking down country after country, bond market after bond market, and even government after government!" "Now is the time to prepare for a Dow crash."

The Aden Forecast

Events in Europe are dominating all of the markets, in one way or another. The situation is intensifying and this is putting downward pressure on stocks, currencies, commodities and metals. U.S. bonds and the dollar are still the best safe havens.

The weakness in the stock market has now been reinforced, across the board. That goes for stocks in the U.S., as well as the international stock markets. The markets are basically worried about the way the European debt crisis is evolving and the effect this will have on the world economy. They are looking ahead and for now, they do not like what they see. All of the stock indices have turned bearish and the major trends will remain down by staying below their moving averages. Continue to avoid stocks for the time being.

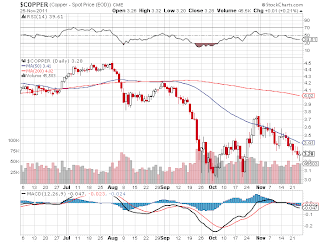

Here is another way to look at the economy. Copper is considered a barometer of the economy. When all is well, construction is robust, therefore increasing the need for copper. Here is the current chart for copper.

You can draw your own conclusion. Our thoughts are downward, so we are out of stocks and we may start shorting the market.

No comments:

Post a Comment